Use the following to answer questions:

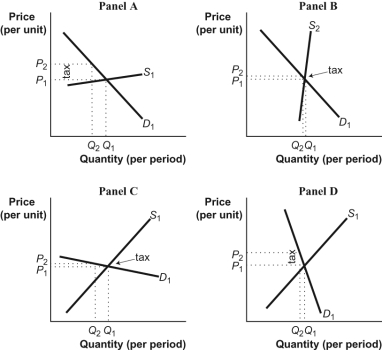

Figure: Tax Incidence

-(Figure: Tax Incidence) Look at the figure Tax Incidence. All other things unchanged, the effect of an excise tax on gasoline in the short run is most likely illustrated by panel _____, and the greater share of the burden of the excise tax (shown by the tax wedge in each panel) is borne by _____.

Definitions:

Erosion Costs

Erosion Costs are the costs incurred due to the negative impact of introducing a new product or project on the sales and revenue of existing products or projects.

Incremental Income

The additional income generated from a particular business decision or action.

Fixed Assets

Assets of a long-term nature such as land, buildings, and machinery, which are used in the operations of a business and not expected to be consumed or converted into cash in the short term.

Net Working Capital

The distinction between what a business owns in the short term (current assets) and what it owes in the short term (current liabilities), reflecting the company's financial health and operational effectiveness.

Q14: The governor wants to levy a $1

Q25: Rent controls in New York City cause

Q58: (Figure: The Demand Curve) Look at the

Q61: Total surplus is:<br>A) the sum of consumer

Q65: (Table: Music Downloads) Two consumers, Eli and

Q156: An increase in the consumer surplus in

Q175: (Figure: Supply and Demand) Look at the

Q206: When a new medical report extols the

Q237: If a tax system is designed to

Q244: (Figure: The Markets for Melons in Russia)