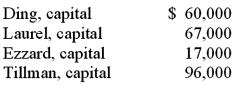

A local partnership was considering the possibility of liquidation since one of the partners (Ding) was personally insolvent. Capital balances at that time were as follows. Profits and losses were divided on a 4:2:2:2 basis, respectively.  Creditors of partner Ding filed a $25,000 claim against the partnership's assets. At that time, the partnership held noncash assets reported at $360,000 and liabilities of $120,000. There was no cash on hand at the time. If the assets could be sold for $228,000, what is the minimum amount that Ezzard's creditors would have received?

Creditors of partner Ding filed a $25,000 claim against the partnership's assets. At that time, the partnership held noncash assets reported at $360,000 and liabilities of $120,000. There was no cash on hand at the time. If the assets could be sold for $228,000, what is the minimum amount that Ezzard's creditors would have received?

Definitions:

Net Present Value

A method used in capital budgeting to evaluate the profitability of an investment, calculated as the difference between the present value of cash inflows and the present value of cash outflows over a period of time.

Estimated Net Income

A projection of a company’s net income, considering potential revenues and expenses, for a future period.

Cash Payback Period

The period of time required for the cash inflows from a capital investment project to equal the cash outflows, typically used as a measure of a project's liquidity.

Annual Net Cash Flows

The total amount of cash generated or spent by a business in a given year after all expenses and revenues.

Q3: Under modified accrual accounting, when should an

Q5: Which statement is false regarding a plan

Q15: Saud examined differences in reading ability between

Q21: A foreign subsidiary uses the first-in first-out

Q21: On December 1, 2011, Keenan Company, a

Q23: Of the following, which is a question

Q26: What are the three broad sections of

Q36: The balance sheet of Rogers, Dennis &

Q42: On January 1, 2011, the partners of

Q75: Which of the following securities offerings is