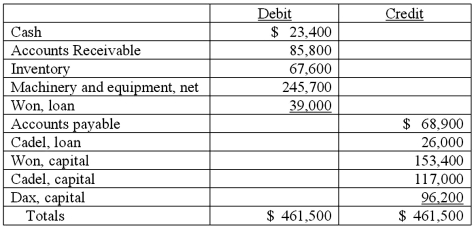

On January 1, 2011, the partners of Won, Cadel, and Dax (who shared profits and losses in the ratio of 5:3:2, respectively) decided to liquidate their partnership. The trial balance at this date was as follows:  The partners planned a program of piecemeal conversion of the business assets to minimize liquidation losses. All available cash, less an amount retained to provide for future expenses, was to be distributed to the partners at the end of each month. A summary of liquidation transactions follows:

The partners planned a program of piecemeal conversion of the business assets to minimize liquidation losses. All available cash, less an amount retained to provide for future expenses, was to be distributed to the partners at the end of each month. A summary of liquidation transactions follows:  Prepare a schedule to calculate the safe payments to be made to the partners at the end of January.

Prepare a schedule to calculate the safe payments to be made to the partners at the end of January.

Definitions:

Same-Sex Affection

Emotional or physical attraction between two individuals of the same gender.

Publicly Tolerated

Accepted or allowed by society, often without formal approval but also without active opposition.

United States

A federal republic consisting of 50 states and a federal district, known for its significant influence on world politics, economy, and culture, located primarily in North America.

Brother-Sister Marriages

Marital or sexual relationships between siblings, observed in certain historical periods or cultures, often with royal or divine justifications.

Q1: Quadros Inc., a Portuguese firm was acquired

Q1: Melanie is a qualitative researcher studying veteran

Q3: A historical exchange rate for common stock

Q7: As part of the hypothesis statement in

Q26: Which of the following is not subtracted

Q28: A gift that is specified in a

Q28: Which of the following statements is generally

Q45: A local partnership was considering the possibility

Q52: In governmental accounting, what term is used

Q76: A company that was to be liquidated