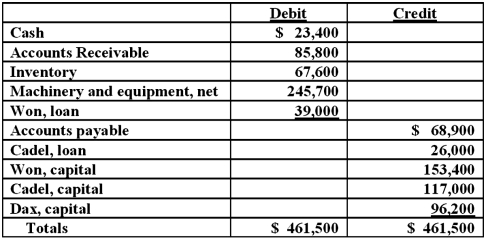

On January 1, 2011, the partners of Won, Cadel, and Dax (who shared profits and losses in the ratio of 5:3:2, respectively) decided to liquidate their partnership. The trial balance at this date was as follows:  The partners planned a program of piecemeal conversion of the business assets to minimize liquidation losses. All available cash, less an amount retained to provide for future expenses, was to be distributed to the partners at the end of each month. A summary of liquidation transactions follows:

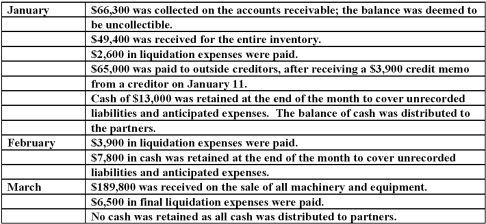

The partners planned a program of piecemeal conversion of the business assets to minimize liquidation losses. All available cash, less an amount retained to provide for future expenses, was to be distributed to the partners at the end of each month. A summary of liquidation transactions follows:  Prepare a schedule to calculate the safe installment payments to be made to the partners at the end of February.

Prepare a schedule to calculate the safe installment payments to be made to the partners at the end of February.

Definitions:

Creative Destruction

A concept in economics which signifies the process by which new innovations lead to the demise of older technologies, leading to economic progress.

Federal Trade Commission

A federal agency charged with protecting consumers and ensuring a strong competitive market by enforcing antitrust and consumer protection laws.

Wheeler-Lea Act

The federal law of 1938 that amended the Federal Trade Commission Act by prohibiting unfair and deceptive acts or practices of commerce (such as false and misleading advertising and the misrepresentation of products).

Misleading Advertising

Promotional activities that intentionally or unintentionally deceive or misguide consumers regarding the nature, qualities, or benefits of a product or service.

Q22: Which entry would be the correct entry

Q28: Who must accept and confirm the Reorganization

Q28: Marie Todd works for the City of

Q29: Jerry, a partner in the JSK partnership,

Q31: Mount Inc. was a hardware store that

Q51: Norton Co., a U.S. corporation, sold inventory

Q61: What are accredited investors?

Q66: Under modified accrual accounting, when should revenues

Q73: The executor of Danny Mack's estate has

Q75: On January 1, 2011, Lamb and Mona