Hardin, Sutton, and Williams have operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.

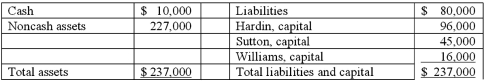

The following balance sheet has been produced:  During the liquidation process, the following transactions take place:

During the liquidation process, the following transactions take place:

- Noncash assets are sold for $116,000.

- Liquidation expenses of $12,000 are paid. No further expenses are expected.

- Safe capital distributions are made to the partners.

- Payment is made of all business liabilities.

- Any deficit capital balances are deemed to be uncollectible.

Prepare journal entries to record the actual liquidation transactions.

Definitions:

Identical Twin

One of a pair of twins who originate from a single fertilized egg, resulting in genetically identical individuals.

GABA

Gamma-Aminobutyric Acid, a key inhibitory neurotransmitter in the brain that helps regulate neuronal excitability and plays a role in reducing anxiety and promoting relaxation.

Psychological Disorder

A condition characterized by significant disturbance in an individual's cognition, emotion regulation, or behavior, typically associated with distress or impairment in functioning.

Anxiety

A disorder of mental wellbeing defined by extreme levels of concern, unease, or fear, sufficiently intense to hamper routine day-to-day actions.

Q2: A company that was to be liquidated

Q5: All of the following data may be

Q11: When reading a recent journal article Juan

Q21: White, Sands, and Luke has the following

Q34: Where should a company undergoing reorganization report

Q35: Marjorie conducted a study of students' views

Q48: Special Revenue funds are<br>A) Funds used to

Q49: Susan examined differences in students' sustained independent

Q63: The Keaton, Lewis, and Meador partnership had

Q71: What is a special revenue fund used