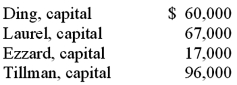

A local partnership was considering the possibility of liquidation since one of the partners (Ding) was personally insolvent. Capital balances at that time were as follows. Profits and losses were divided on a 4:2:2:2 basis, respectively.  Creditors of partner Ding filed a $25,000 claim against the partnership's assets. At that time, the partnership held noncash assets reported at $360,000 and liabilities of $120,000. There was no cash on hand at the time. If the assets could be sold for $228,000, what is the minimum amount that Ding's creditors would have received?

Creditors of partner Ding filed a $25,000 claim against the partnership's assets. At that time, the partnership held noncash assets reported at $360,000 and liabilities of $120,000. There was no cash on hand at the time. If the assets could be sold for $228,000, what is the minimum amount that Ding's creditors would have received?

Definitions:

Corrective Action

Steps taken to rectify a problem or defect to prevent recurrence and ensure improvement.

Leading

The act of guiding and directing a group to meet its goals through influencing and motivating its members.

Upside-Down Pyramid

An organizational structure where decision-making is more decentralized and lower-level employees have more power and responsibilities.

Helping

Helping involves providing support or assistance to others, often to improve a situation or solve a problem, fostering a collaborative and supportive environment.

Q7: During the current year, an estate generates

Q10: The employees of the City of Raymond

Q10: The partnership of Clapton, Seidel, and Thomas

Q12: What should occur when a solvent partner

Q21: For not-for-profit organizations, what is the difference

Q35: The Town of Conway opened a solid

Q46: Car Corp. (a U.S.-based company) sold parts

Q48: In countries where there is less pressure

Q53: What are the goals of probate laws?

Q61: In not-for-profit accounting, an acquisition occurs when