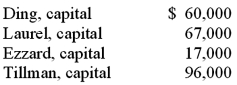

A local partnership was considering the possibility of liquidation since one of the partners (Ding) was personally insolvent. Capital balances at that time were as follows. Profits and losses were divided on a 4:2:2:2 basis, respectively.  Creditors of partner Ding filed a $25,000 claim against the partnership's assets. At that time, the partnership held noncash assets reported at $360,000 and liabilities of $120,000. There was no cash on hand at the time. If the assets could be sold, for $228,000 what is the minimum amount that Tillman's creditors would have received?

Creditors of partner Ding filed a $25,000 claim against the partnership's assets. At that time, the partnership held noncash assets reported at $360,000 and liabilities of $120,000. There was no cash on hand at the time. If the assets could be sold, for $228,000 what is the minimum amount that Tillman's creditors would have received?

Definitions:

Inventory

The total amount of goods and materials held by a company intended for sale in the ordinary course of business.

Incremental Cash Flows

The additional cash inflows or outflows expected from a new project or investment, crucial for determining its net present value.

Capital Budgeting

The process of planning and managing a company's long-term investments in projects and assets, to maximize returns and shareholder value.

Incremental Cash Flows

The additional cash flow a company receives from taking on a new project, excluding any cash flows not directly attributable to the project.

Q2: Norton Co., a U.S. corporation, sold inventory

Q3: Assume the partnership of Dean, Hardin, and

Q6: One benefit of Zotero over other reference

Q8: What exchange rate would be used to

Q42: The SEC's role in the initial registration

Q43: Property taxes of 1,500,000 are levied for

Q51: Which of the following statements is true

Q61: During the most recent year, an estate

Q62: If the total acquisition value of an

Q65: The translation adjustment from translating a foreign