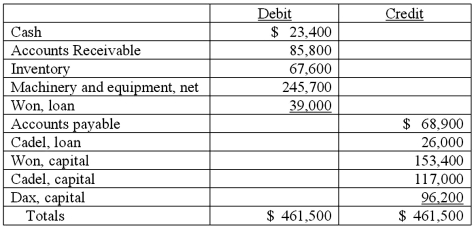

On January 1, 2011, the partners of Won, Cadel, and Dax (who shared profits and losses in the ratio of 5:3:2, respectively) decided to liquidate their partnership. The trial balance at this date was as follows:  The partners planned a program of piecemeal conversion of the business assets to minimize liquidation losses. All available cash, less an amount retained to provide for future expenses, was to be distributed to the partners at the end of each month. A summary of liquidation transactions follows:

The partners planned a program of piecemeal conversion of the business assets to minimize liquidation losses. All available cash, less an amount retained to provide for future expenses, was to be distributed to the partners at the end of each month. A summary of liquidation transactions follows:  Prepare a schedule to calculate the safe payments to be made to the partners at the end of January.

Prepare a schedule to calculate the safe payments to be made to the partners at the end of January.

Definitions:

Sleep Deprivation

A condition resulting from insufficient sleep, which can affect cognitive functions, emotional well-being, and physical health.

Slow-wave Sleep

A deep phase of sleep characterized by slow brain waves, where the brain and body have the opportunity to rejuvenate and consolidate memories.

REM Sleep

A stage of sleep characterized by rapid eye movements, increased brain activity, and vivid dreams.

Voluntary Muscle Activity

Muscle movements that are under conscious control, involving skeletal muscles and used to perform deliberate actions.

Q1: Quadros Inc., a Portuguese firm was acquired

Q3: Margarita is cautious about her analysis. She

Q8: Which statement is false regarding the Balance

Q20: Laili integrates her data from her study

Q27: What is a proxy? Briefly explain the

Q46: How are investments in equity securities with

Q49: Jill, a sociologist, is interested in social

Q59: When a U.S. company purchases parts from

Q66: The Henry, Isaac, and Jacobs partnership was

Q67: Which one of the following forms is