Hardin, Sutton, and Williams have operated a local business as a partnership for several years. All profits and losses have been allocated in a 3:2:1 ratio, respectively. Recently, Williams has undergone personal financial problems, and is insolvent. To satisfy Williams' creditors, the partnership has decided to liquidate.

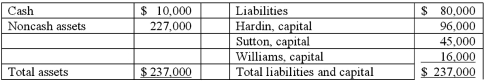

The following balance sheet has been produced:  During the liquidation process, the following transactions take place:

During the liquidation process, the following transactions take place:

- Noncash assets are sold for $116,000.

- Liquidation expenses of $12,000 are paid. No further expenses are expected.

- Safe capital distributions are made to the partners.

- Payment is made of all business liabilities.

- Any deficit capital balances are deemed to be uncollectible.

Compute safe cash payments after the noncash assets have been sold and the liquidation expenses have been paid.

Definitions:

Actigraph

A device typically worn on the wrist that tracks movement and is often used to monitor sleep patterns and physical activity levels.

Wristwatch-Like Device

A portable, wearable gadget, typically electronic and worn on the wrist, resembling a watch but often capable of performing various functions beyond timekeeping.

Stress

A physical and emotional response to a challenge or demand, often perceived as a threat, which can affect mental and physical health.

Sleep Problems

Issues related to sleeping, such as insomnia, sleep apnea, or narcolepsy, affecting the quality or duration of sleep.

Q9: What is a private placement of securities?

Q12: Both Marianne and Bill examined the same

Q16: The executor of Danny Mack's estate has

Q27: Bazley Co. had severe financial difficulties and

Q37: The provisions of a will currently undergoing

Q43: Which of the following is generally true

Q47: Under what circumstance does an estate have

Q52: A local partnership has assets of cash

Q70: Esposito is an Italian subsidiary of a

Q72: A company that was to be liquidated