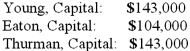

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner: Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

The Articles of Partnership stipulated that profits and losses be assigned in the following manner: Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.

The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.

Each partner withdrew $13,000 per year.

Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.

What was Thurman's total share of net loss for the first year?

Definitions:

Mental Reframing

The process of intentionally shifting one's perspective on a situation to change its emotional impact, often used in cognitive behavioral therapy.

Action Identification Theory

A psychological theory that explains how individuals conceive of their actions in terms of higher-level goals or lower-level details.

Concrete Goal

A specific, clearly defined, and measurable objective that an individual or group aims to achieve.

Two-Factor Theory

A concept in psychology that proposes emotional experiences arise from a combination of a state of physiological arousal and a cognitive interpretation of that arousal.

Q16: What are duties of the creditors committee

Q18: A company that was to be liquidated

Q20: Quincy Corp., about to be liquidated, has

Q21: Your text indicates that the last step

Q21: A foreign subsidiary uses the first-in first-out

Q24: Executor's fees and court costs for settling

Q37: Which accounts are remeasured using current exchange

Q43: Property taxes of 1,500,000 are levied for

Q49: For the month of December 2011, patient

Q51: Which one of the following forms is