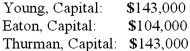

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner: Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

The Articles of Partnership stipulated that profits and losses be assigned in the following manner: Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.

The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.

Each partner withdrew $13,000 per year.

Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.

What was the balance in Young's Capital account at the end of the second year?

Definitions:

Differentiation

Relates to distinguishing or creating differences between products, services, or organizational entities to create a competitive advantage.

Strategic Choice

Refers to the decisions that determine the direction of an organization's long-term goals and the means to achieve them.

Competitive Advantage

The attributes or conditions that enable a company to outperform its competitors, such as superior quality, innovative technology, or cost efficiency.

Unique Capabilities

Special abilities or strengths that set an individual, team, or organization apart from others.

Q5: Jill reported in her research that there

Q7: During the current year, an estate generates

Q9: The following items are required to be

Q14: EDGAR stands for:<br>A) Electronic Debits, Gains, Assets

Q15: Dean Hardware, Inc. is comprised of five

Q19: An executor will normally carry out all

Q41: What occurs in the accounting records for

Q42: The executor of Danny Mack's estate has

Q50: The partners of Donald, Chief & Berry

Q75: When should property taxes be recognized under