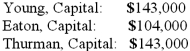

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner: Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

The Articles of Partnership stipulated that profits and losses be assigned in the following manner: Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.

The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.

Each partner withdrew $13,000 per year.

Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.

What was the balance in Eaton's Capital account at the end of the second year?

Definitions:

Moral Isolationism

The belief that one cannot or should not make moral judgments about the practices of cultures other than one's own.

Historical Periods

Distinct phases or eras in history categorized by significant events or developments, such as technological advancements, cultural shifts, or political transformations.

Metaethics

The branch of philosophy that analyzes the meaning and nature of moral terms, judgments, and arguments.

Normative Ethics

The branch of ethics concerned with establishing how things should or ought to be, how to value them, which actions are right or wrong, and which traits of character are good or bad.

Q6: The partners of Donald, Chief & Berry

Q6: A company incurs research and development costs

Q13: On December 1, 2011, Keenan Company, a

Q19: When an acquisition occurs in not-for-profit accounting,

Q21: For not-for-profit organizations, what is the difference

Q32: When an estate does not have sufficient

Q39: Why is the SEC's Rule 14c-3 important

Q63: A $910,000 bond was issued on October

Q73: Alpha, Inc., a U.S. company, had a

Q73: What is the justification for the remeasurement