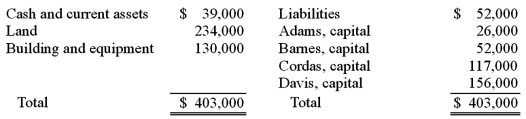

The ABCD Partnership has the following balance sheet at January 1, 2010, prior to the admission of new partner, Eden.  Eden acquired a 20% interest in the partnership by contributing a total of $71,500 directly to the other four partners. Goodwill is to be recorded. Profits and losses have previously been split according to the following percentages: Adams, 15%; Barnes, 35%; Cordas, 30%; and Davis, 20%. After Eden made his investment, what were the individual capital balances?

Eden acquired a 20% interest in the partnership by contributing a total of $71,500 directly to the other four partners. Goodwill is to be recorded. Profits and losses have previously been split according to the following percentages: Adams, 15%; Barnes, 35%; Cordas, 30%; and Davis, 20%. After Eden made his investment, what were the individual capital balances?

Definitions:

Competitive Disadvantage

A condition or circumstance that puts a company at a less favorable position in the market compared to its competitors.

Financial Statements

Reports outlining a firm's financial health, encompassing its balance sheet, income statement, and cash flow statement.

Rigid Guidelines

Strict rules or procedures that are followed without allowance for flexibility.

Generally Accepted Guidelines

Broad principles, standards, and norms adhered to in a particular field or profession.

Q7: Prepare the journal entry and identify the

Q11: How may real property be treated in

Q22: On June 14, 2011, Fred City agreed

Q25: When a city holds pension monies for

Q28: What factors create a foreign exchange gain?

Q36: Wakefield Home is a private not-for-profit healthcare

Q58: What assets would be included in the

Q62: A local partnership was in the process

Q62: On October 31, 2010, Darling Company negotiated

Q70: The forward rate may be defined as<br>A)