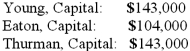

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner: Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

The Articles of Partnership stipulated that profits and losses be assigned in the following manner: Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.

The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.

Each partner withdrew $13,000 per year.

Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.

What was Young's total share of net loss for the first year?

Definitions:

Information Management

The process of collecting, storing, managing, and distributing information in an effective and secure manner.

Process Improvement

The proactive task of identifying, analyzing, and improving upon existing business processes within an organization to optimize performance or meet new quotas or standards.

Employee Compensation

The package of wages, salaries, and benefits that employees receive in exchange for their work.

HCR-20

A tool used for assessing the risk of violence in individuals, considering historical, clinical, and risk management factors.

Q5: All of the following data may be

Q8: A company sells a building to a

Q22: Making sense of what data mean is

Q23: Norton Co., a U.S. corporation, sold inventory

Q23: Of the following, which is a question

Q44: For a not-for-profit organization, when is recognition

Q48: On January 1, 2011, Lamb and Mona

Q53: Which of the following statements is correct

Q62: Whitley Corporation identified four operating segments: Automotive,

Q71: When there are not enough assets in