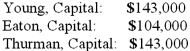

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner: Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

The Articles of Partnership stipulated that profits and losses be assigned in the following manner: Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.

The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.

Each partner withdrew $13,000 per year.

Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.

What was Thurman's total share of net loss for the first year?

Definitions:

Nominal Exchange Rate

The price at which one currency can be exchanged for another currency, without adjustment for inflation.

Pesos

Pesos are the unit of currency in several countries, including Mexico and the Philippines.

Purchasing-Power Parity

An economic principle positing that currency exchange rates reach equilibrium when the purchasing power in both countries involved is equal.

Depreciated

The decrease in value of an asset over time, often due to wear and tear or obsolescence.

Q4: Schilling, Inc. has three operating segments with

Q7: A company that was to be liquidated

Q16: How do the balance sheet and statement

Q18: A company that was to be liquidated

Q19: The employees of the City of Raymond

Q29: Salaries and wages that have been earned

Q32: Which two EU directives have helped harmonize

Q33: Dilty Corp. owned a subsidiary in France.

Q57: Lucky Co. had cash of $65,000, inventory

Q86: Kennedy Company acquired all of the outstanding