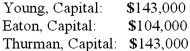

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner: Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

The Articles of Partnership stipulated that profits and losses be assigned in the following manner: Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.

The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.

Each partner withdrew $13,000 per year.

Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.

What was the balance in Young's Capital account at the end of the second year?

Definitions:

Q6: One benefit of Zotero over other reference

Q12: According to GASB Concepts Statement No. 1,

Q21: A description of the sample participants of

Q36: Yaseen's research has addressed middle school students'

Q43: The SEC's operating costs are supported through<br>A)

Q46: According to the GASB (Governmental Accounting Standards

Q73: GASB Codification Section N50.104 divides all eligibility

Q74: The ABCD Partnership has the following balance

Q93: Winston Corp., a U.S. company, had the

Q96: Under the current rate method, inventory at