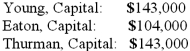

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner: Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

The Articles of Partnership stipulated that profits and losses be assigned in the following manner: Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.

The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.

Each partner withdrew $13,000 per year.

Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.

What was the balance in Eaton's Capital account at the end of the second year?

Definitions:

Osteoclast Activity

Biological processes involving osteoclast cells, which break down bone tissue, facilitating bone resorption and remodeling.

Calcitonin

A hormone produced by the thyroid gland that helps regulate calcium levels in the blood by inhibiting osteoclast activity.

Broken Bone

A fracture or disruption in the continuity of a bone, often caused by trauma, stress, or disease.

Internal Callus

The internal mass of fibrous tissue and cartilage formed between the ends of a fractured bone during the healing process.

Q2: Of the following, which is a qualitative

Q6: A five-year lease is signed by the

Q12: Primo Inc., a U.S. company, ordered parts

Q19: When Michele reached the method section of

Q27: Reed, Sharp, and Tucker were partners with

Q33: Judy forgot to mention that the survey

Q38: The reporting of the fund balance of

Q42: Cleary, Wasser, and Nolan formed a partnership

Q79: A net asset balance sheet exposure exists

Q84: Esposito is an Italian subsidiary of a