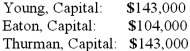

A partnership began its first year of operations with the following capital balances:  The Articles of Partnership stipulated that profits and losses be assigned in the following manner: Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

The Articles of Partnership stipulated that profits and losses be assigned in the following manner: Young was to be awarded an annual salary of $26,000 with $13,000 salary assigned to Thurman.

Each partner was to be attributed with interest equal to 10% of the capital balance as of the first day of the year.

The remainder was to be assigned on a 5:2:3 basis to Young, Eaton, and Thurman, respectively.

Each partner withdrew $13,000 per year.

Assume that the net loss for the first year of operations was $26,000 with net income of $52,000 in the second year.

What was the balance in Thurman's Capital account at the end of the second year?

Definitions:

Economic Profit

The profit from undertaking an activity after subtracting both the explicit and implicit costs associated with that activity.

Implicit Costs

Expenses that do not involve a direct monetary payment but represent the opportunity cost of using resources owned by the company or individual.

Average Cost of Production

The total cost of production divided by the quantity of output produced, indicating the cost to produce each unit of output.

Total Profit

The net profit a company earns, calculated by deducting all costs from its total income.

Q2: In a will, a devise is a<br>A)

Q8: Coyote Corp. (a U.S. company in Texas)

Q23: The following information pertains to inventory held

Q39: Ar-Mu'min has conducted a study that examines

Q43: Property taxes of 1,500,000 are levied for

Q45: On January 1, 2011, Veldon Co., a

Q51: The executor of the Estate of Kate

Q73: The goals of the SEC include all

Q74: What is shelf registration?<br>A) a procedure that

Q108: Natarajan, Inc. had the following operating segments,