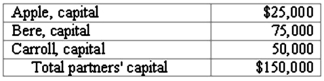

The partners of Apple, Bere, and Carroll LLP share net income and losses in a 5:3:2 ratio, respectively. The capital account balances on January 1, 2011, were as follows:  The carrying amounts of the assets and liabilities of the partnership are the same as their current fair values. Dorr will be admitted to the partnership with a 20% capital interest and a 20% share of net income and losses in exchange for a cash investment. The amount of cash that Dorr should invest in the partnership is:

The carrying amounts of the assets and liabilities of the partnership are the same as their current fair values. Dorr will be admitted to the partnership with a 20% capital interest and a 20% share of net income and losses in exchange for a cash investment. The amount of cash that Dorr should invest in the partnership is:

Definitions:

Q3: The City of Wetteville has a fiscal

Q18: Henry has a large body of qualitative

Q29: Which entry would be the correct entry

Q36: Which of the following is not a

Q38: For the month of December 2011, patient

Q39: Why is the SEC's Rule 14c-3 important

Q49: The City of Kamen transferred $27,000 into

Q53: Which of the following statements is correct

Q56: What is the purpose of Chapter 7

Q60: Which one of the following requires the