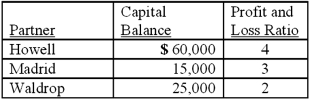

Assume the partnership of Howell, Madrid, and Waldrop has been in existence for a number of years. Howell decides to withdraw from the partnership when the partners' capital balances are as follows:  An appraisal of the business and its net assets estimates the fair value to be $154,000. Land with a book value of $20,000 has a fair value of $35,000. Howell has agreed to receive $84,000 in exchange for her partnership interest.

An appraisal of the business and its net assets estimates the fair value to be $154,000. Land with a book value of $20,000 has a fair value of $35,000. Howell has agreed to receive $84,000 in exchange for her partnership interest.

Prepare the journal entries for the dissolution of Howell's partnership interest, assuming the goodwill method is to be applied.

Definitions:

Decreased

A reduction in size, number, value, or extent of something.

Cancer Deaths

Fatalities that occur as a direct result of cancer or its treatment, encompassing all types of cancer.

Radiation

The emission of energy as electromagnetic waves or as moving subatomic particles, especially high-energy particles that cause ionization.

Nuclear Power Plant

A facility that uses nuclear reactions to generate heat, which is then used to produce electricity.

Q6: On October 1, 2011, Eagle Company forecasts

Q8: Which one of the following financial statements

Q31: What is the preferred method of resolving

Q38: Withdrawals from the partnership capital accounts are

Q38: Which statement is true regarding a foreign

Q40: Ankur is writing his report on his

Q48: Which one of the following items is

Q53: Xygote, Yen, and Zen were partners who

Q70: The Henry, Isaac, and Jacobs partnership was

Q77: Mandich Co. had the following amounts for