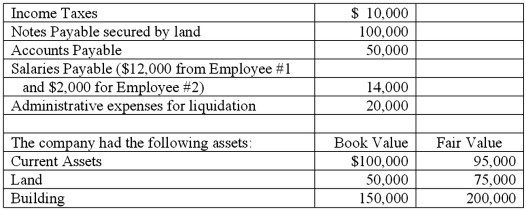

A company that was to be liquidated had the following liabilities:  Assets available for unsecured creditors after payments of liabilities with priority are calculated to be what amount?

Assets available for unsecured creditors after payments of liabilities with priority are calculated to be what amount?

Definitions:

Truth in Lending Act

A U.S. federal law designed to promote the informed use of consumer credit by requiring disclosures about its terms and cost.

Consumer Credit Advertising

Marketing efforts aimed at promoting credit transactions to consumers, regulated to ensure fairness and transparency.

Baiting

involves luring someone by offering something enticing but not intending to deliver as promised, often used in deceptive marketing practices.

Truth in Lending Act

A federal law designed to protect consumers in credit transactions by requiring clear disclosure of key terms of the lending arrangement and all costs.

Q6: A five-year lease is signed by the

Q10: Which of the following is not an

Q31: Under the current rate method, property, plant

Q34: Provo, Inc. has an estimated annual tax

Q37: What happens when a U.S. company purchases

Q38: Quadros Inc., a Portuguese firm was acquired

Q42: Which of the following statements is true

Q42: The SEC's role in the initial registration

Q57: The SEC has usually restricted its role

Q74: Which of the following is not a