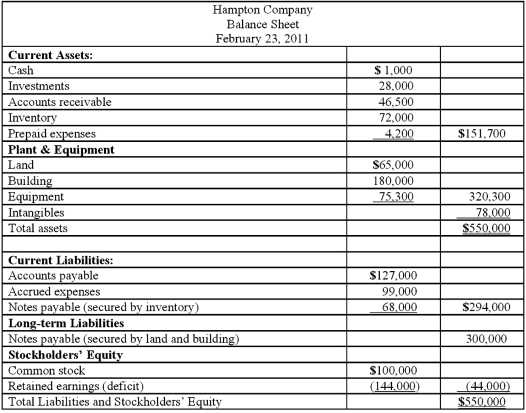

Hampton Company is trying to decide whether to seek liquidation or reorganization. Hampton has provided the following balance sheet:  Additional information is as follows:

Additional information is as follows:

● The investments are currently worth $13,000.

● It is estimated that $32,000 of the accounts receivable are collectible.

● The inventory can be sold for $74,000.

● The prepaid expenses and the intangible assets have no net realizable value.

● The land and building are currently valued at $250,000.

● The equipment can be sold for $60,000.

● Administrative expenses (not yet recorded) are estimated to be $12,500.

● Accrued expenses include $17,000 of salaries payable ($11,000 to one employee and $3,000 each to two other employees).

● Accrued expenses include $7,000 of unpaid payroll taxes.

Compute the amount of unsecured liabilities without priority.

Definitions:

Iris

The colored part of the eye surrounding the pupil, which adjusts the size of the pupil to regulate the amount of light entering the eye.

Pupil

The central, circular opening in the iris of the eye, which regulates the amount of light that enters the eye to reach the retina.

Iris

The colored part of the eye surrounding the pupil, responsible for controlling the diameter and size of the pupil and thus the amount of light reaching the retina.

Visible Light Waves

Electromagnetic waves that are visible to the human eye, which perceive them as colors.

Q22: Which entry would be the correct entry

Q31: Audited financial statements in an annual report

Q42: The City of Wetteville has a fiscal

Q48: Hardford Corp. held 80% of Inglestone Inc.

Q49: Bazley Co. had severe financial difficulties and

Q55: On October 1, 2011, Eagle Company forecasts

Q57: Gregor Inc. uses the LIFO cost-flow assumption

Q60: A company that generates reports by both

Q90: According to U.S. GAAP for a local

Q112: Hardford Corp. held 80% of Inglestone Inc.