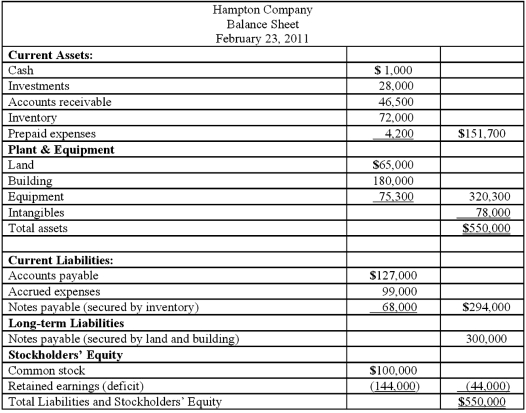

Hampton Company is trying to decide whether to seek liquidation or reorganization. Hampton has provided the following balance sheet:  Additional information is as follows:

Additional information is as follows:

● The investments are currently worth $13,000.

● It is estimated that $32,000 of the accounts receivable are collectible.

● The inventory can be sold for $74,000.

● The prepaid expenses and the intangible assets have no net realizable value.

● The land and building are currently valued at $250,000.

● The equipment can be sold for $60,000.

● Administrative expenses (not yet recorded) are estimated to be $12,500.

● Accrued expenses include $17,000 of salaries payable ($11,000 to one employee and $3,000 each to two other employees).

● Accrued expenses include $7,000 of unpaid payroll taxes.

What is the payout percentage to unsecured creditors? (Round the percentage to a whole number and two decimal places.)

Definitions:

Poisson Random Variable

A statistical measure that represents the number of events occurring in a fixed interval of time or space which are independent of each other.

Poisson Process

A stochastic process that models the occurrence of events in fixed intervals of time or space where events occur with a constant mean rate and independently of the time since the last event.

Random Pattern

An arrangement or distribution showing no regularity or discernible order, often analyzed to understand the randomness in spatial or sequence data.

Teamwork

Collaborative effort by a group of people to achieve a common goal or complete a task in the most effective and efficient way.

Q4: Coyote Corp. (a U.S. company in Texas)

Q12: Primo Inc., a U.S. company, ordered parts

Q22: Which of the following statements is false

Q23: On January 1, 2011, Wakefield City purchased

Q30: What are third party payors? Why are

Q46: The provisions of a will currently undergoing

Q46: What was the purpose of the Securities

Q58: Under the temporal method, property, plant &

Q82: Parker Corp., a U.S. company, had the

Q88: The capital account balances for Donald &