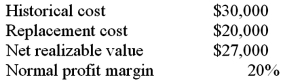

The following information pertains to inventory held by a company on December 31, 2011.  As a result of inventory loss, what is the difference in income between reporting using U.S. GAAP and IFRS?

As a result of inventory loss, what is the difference in income between reporting using U.S. GAAP and IFRS?

Definitions:

Dividend Declaration

The action by a company's board of directors to set the amount and date of a dividend payment to shareholders.

Noncumulative

Pertaining to dividends or preferred stock where undeclared or unpaid dividends do not accumulate and are not owed in future periods.

Common Stockholders

Individuals or entities that own shares of a company's common stock, granting them voting rights and a share of the company's profits through dividends.

Dividend Payment

A dividend payment is a distribution of a portion of a company's earnings to its shareholders, typically made in cash or additional stock.

Q2: Norton Co., a U.S. corporation, sold inventory

Q7: Donald, Anne, and Todd have the following

Q13: Which statement is false regarding the Statement

Q17: Which of the following is not an

Q22: What is meant by a "fully secured

Q38: What is the role of the accountant

Q44: On October 1, 2011, Jarvis Co. sold

Q56: What is the purpose of fund financial

Q113: Which of the segments are separately reportable?<br>A)

Q113: What are the benefits or advantages of