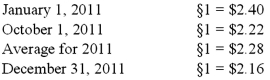

Ginvold Co. began operating a subsidiary in a foreign country on January 1, 2011 by acquiring all of the common stock for §50,000 Stickles, the local currency. This subsidiary immediately borrowed §120,000 on a five-year note with ten percent interest payable annually beginning on January 1, 2012. A building was then purchased for §170,000 on January 1, 2011. This property had a ten-year anticipated life and no salvage value and was to be depreciated using the straight-line method. The building was immediately rented for three years to a group of local doctors for §6,000 per month. By year-end, payments totaling §60,000 had been received. On October 1, §5,000 were paid for a repair made on that date and it was the only transaction of this kind for the year. A cash dividend of §6,000 was transferred back to Ginvold on December 31, 2011. The functional currency for the subsidiary was the Stickle (§). Currency exchange rates were as follows:  Prepare a statement of cash flows for this subsidiary in stickles and then translate the amounts into U.S. dollars.

Prepare a statement of cash flows for this subsidiary in stickles and then translate the amounts into U.S. dollars.

Definitions:

Ear Infection

An infection located in the ear, typically affecting the middle ear, characterized by inflammation and often causing pain and temporary hearing impairment.

Retrospective Memory

The ability to remember events, information, or experiences from the past.

Childhood Home

The house or environment where one spends the formative years of their childhood.

Porch Swing

A hanging bench or seat usually found on the porch of a house that swings back and forth.

Q28: How should contingencies be reported in an

Q31: Mount Inc. was a hardware store that

Q38: Gargiulo Company, a 90% owned subsidiary of

Q58: On December 1, 2011, Keenan Company, a

Q62: Whitley Corporation identified four operating segments: Automotive,

Q64: Lucky Co. had cash of $65,000, inventory

Q76: According to U.S. GAAP, what general information

Q84: Cleary, Wasser, and Nolan formed a partnership

Q86: Alpha Corporation owns 100 percent of Beta

Q90: Which of the following statements is true