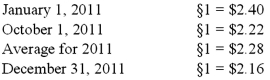

Ginvold Co. began operating a subsidiary in a foreign country on January 1, 2011 by acquiring all of the common stock for §50,000 Stickles, the local currency. This subsidiary immediately borrowed §120,000 on a five-year note with ten percent interest payable annually beginning on January 1, 2012. A building was then purchased for §170,000 on January 1, 2011. This property had a ten-year anticipated life and no salvage value and was to be depreciated using the straight-line method. The building was immediately rented for three years to a group of local doctors for §6,000 per month. By year-end, payments totaling §60,000 had been received. On October 1, §5,000 were paid for a repair made on that date and it was the only transaction of this kind for the year. A cash dividend of §6,000 was transferred back to Ginvold on December 31, 2011. The functional currency for the subsidiary was the Stickle (§). Currency exchange rates were as follows:  Prepare a balance sheet for this subsidiary in stickles and then translate the amounts into U.S. dollars.

Prepare a balance sheet for this subsidiary in stickles and then translate the amounts into U.S. dollars.

Definitions:

Felony

A serious crime, usually punishable by imprisonment for more than one year or by death, examples include murder, rape, and robbery.

Tort

A civil wrong that causes a claimant to suffer loss or harm, resulting in legal liability for the person who commits the tortious act.

Malpractice Lawsuit

A legal case brought against healthcare providers for injury caused to a patient due to professional negligence or failure to provide adequate care.

Lack of Informed Consent

A situation where a patient has not been adequately informed about the risks and benefits of a medical procedure or treatment before agreeing to it.

Q4: The following account balances were available for

Q5: Which statement is false regarding a plan

Q11: What term is used for a bankruptcy

Q19: Under modified accrual accounting, when are expenditures

Q22: What is shelf registration?

Q28: Jell and Dell were partners with capital

Q44: Dancey, Reese, Newman, and Jahn were partners

Q58: What are the four interconnected goals that

Q60: Which one of the following requires the

Q91: A U.S. company's foreign subsidiary had the