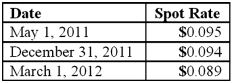

On May 1, 2011, Mosby Company received an order to sell a machine to a customer in Canada at a price of 2,000,000 Mexican pesos. The machine was shipped and payment was received on March 1, 2012. On May 1, 2011, Mosby purchased a put option giving it the right to sell 2,000,000 pesos on March 1, 2012 at a price of $190,000. Mosby properly designates the option as a fair value hedge of the peso firm commitment. The option cost $3,000 and had a fair value of $3,200 on December 31, 2011. The following spot exchange rates apply:  Mosby's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803. What was the impact on Mosby's 2011 net income as a result of this fair value hedge of a firm commitment?

Mosby's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803. What was the impact on Mosby's 2011 net income as a result of this fair value hedge of a firm commitment?

Definitions:

Full-Time

Employment or educational status that typically requires a person's full availability during regular working or schooling hours.

Socialization

The process by which individuals learn and adopt the norms, values, behaviors, and social skills appropriate to their society or social group.

Perspective-Taking

The ability to understand and consider the world from someone else's viewpoint, an important social-cognitive skill in developing empathy.

Independence

The state or quality of being self-reliant and autonomous, free from external control or support.

Q6: Wolff Corporation owns 70 percent of the

Q10: Which statement is false regarding the Public

Q13: Edgar Co. acquired 60% of Stendall Co.

Q31: Coyote Corp. (a U.S. company in Texas)

Q36: Lawyer's fees incurred during a reorganization are

Q48: The following information has been taken from

Q50: What information is included on the statement

Q76: A company that was to be liquidated

Q79: Which of the following statements is true

Q103: Which of the following characteristics is not