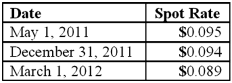

On May 1, 2011, Mosby Company received an order to sell a machine to a customer in Canada at a price of 2,000,000 Mexican pesos. The machine was shipped and payment was received on March 1, 2012. On May 1, 2011, Mosby purchased a put option giving it the right to sell 2,000,000 pesos on March 1, 2012 at a price of $190,000. Mosby properly designates the option as a fair value hedge of the peso firm commitment. The option cost $3,000 and had a fair value of $3,200 on December 31, 2011. The following spot exchange rates apply:  Mosby's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803. What was the impact on Mosby's 2012 net income as a result of this fair value hedge of a firm commitment?

Mosby's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803. What was the impact on Mosby's 2012 net income as a result of this fair value hedge of a firm commitment?

Definitions:

Medical Expenses

Costs incurred from services rendered by healthcare professionals, prescription medications, and medical goods.

Funeral Expenses

Funeral Expenses refer to the costs associated with conducting a funeral and burial or cremation, including services, casket, and cemetery plot or crematorium fees.

Q11: Pot Co. holds 90% of the common

Q12: Hampton Company is trying to decide whether

Q27: Reed, Sharp, and Tucker were partners with

Q34: Ginvold Co. began operating a subsidiary in

Q35: Jull Corp. owned 80% of Solaver Co.

Q46: What is the meaning of the phrase

Q52: A local partnership has assets of cash

Q54: Ryan Company owns 80% of Chase Company.

Q84: Esposito is an Italian subsidiary of a

Q86: Clemente Co. owned all of the voting