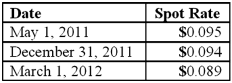

On May 1, 2011, Mosby Company received an order to sell a machine to a customer in Canada at a price of 2,000,000 Mexican pesos. The machine was shipped and payment was received on March 1, 2012. On May 1, 2011, Mosby purchased a put option giving it the right to sell 2,000,000 pesos on March 1, 2012 at a price of $190,000. Mosby properly designates the option as a fair value hedge of the peso firm commitment. The option cost $3,000 and had a fair value of $3,200 on December 31, 2011. The following spot exchange rates apply:  Mosby's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803. What was the overall result of having entered into this hedge of exposure to foreign exchange risk?

Mosby's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803. What was the overall result of having entered into this hedge of exposure to foreign exchange risk?

Definitions:

Nausea And Vomiting

Symptoms involving an uneasy stomach and the act of expelling stomach contents through the mouth, often occurring together.

Ginger

A root herb known for its medicinal properties, commonly used to alleviate gastrointestinal distress, reduce nausea, and enhance immune function.

Irritable Bowel Syndrome

A common disorder affecting the large intestine, characterized by symptoms including cramping, abdominal pain, bloating, gas, and diarrhea or constipation.

Imagery

The use of vivid or figurative language to represent objects, actions, or ideas, often utilized in literature and psychology to evoke sensory experiences.

Q4: Tate, Inc. owns 80 percent of Jeffrey,

Q12: Strayten Corp. is a wholly owned subsidiary

Q18: Partnerships have alternative legal forms including all

Q27: In the United States, foreign companies filing

Q27: Betsy Kirkland, Inc. incurred a flood loss

Q38: List the five aggregation criteria that need

Q48: On January 1, 2010, Smeder Company, an

Q60: The balance sheet of Rogers, Dennis &

Q91: Elektronix, Inc. has three operating segments with

Q105: Beagle Co. owned 80% of Maroon Corp.