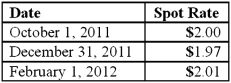

On October 1, 2011, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2012, at a price of 100,000 British pounds. On October 1, 2011, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2011, the option has a fair value of $1,600. The following spot exchange rates apply:  What is the amount of Cost of Goods Sold for 2012 as a result of these transactions?

What is the amount of Cost of Goods Sold for 2012 as a result of these transactions?

Definitions:

Header & Footer Tools

Features in document editing software that allow the user to customize the top and bottom sections of pages with consistent text, page numbers, or graphics.

Hyperlinks

Texts or graphical elements that, when clicked, navigate to another location within the same document or to an entirely different document or website.

Websites

Digital locations accessible via the internet, consisting of one or more web pages that provide content or services to users.

Tabloid-Sized Poster

A large poster with dimensions typically measuring 11 inches by 17 inches, used for advertising, announcements, or artistic displays.

Q11: Thomas Inc. had the following stockholders' equity

Q19: Boerkian Co. started 2011 with two assets:

Q30: Strickland Company sells inventory to its parent,

Q45: Pepe, Incorporated acquired 60% of Devin Company

Q47: Which of the following are not authoritative

Q47: During a reorganization, how should interest expense

Q68: Coyote Corp. (a U.S. company in Texas)

Q77: Peterson Corporation has three operating segments with

Q85: Certain balance sheet accounts of a foreign

Q100: All of the following are required to