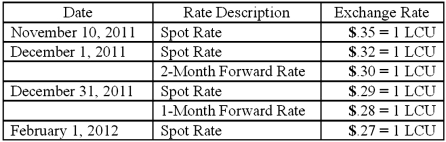

On November 10, 2011, King Co. sold inventory to a customer in a foreign country. King agreed to accept 96,000 local currency units (LCU) in full payment for this inventory. Payment was to be made on February 1, 2012. On December 1, 2011, King entered into a forward exchange contract wherein 96,000 LCU would be delivered to a currency broker in two months. The two month forward exchange rate on that date was 1 LCU = $.30. Any contract discount or premium is amortized using the straight-line method. The spot rates and forward rates on various dates were as follows:  The company's borrowing rate is 12%. The present value factor for one month is .9901.

The company's borrowing rate is 12%. The present value factor for one month is .9901.

(A.) Assume this hedge is designated as a cash flow hedge. Prepare the journal entries relating to the transaction and the forward contract.

(B.) Compute the effect on 2011 net income.

(C.) Compute the effect on 2012 net income.

Definitions:

Lab

Short for laboratory, a facility that provides controlled conditions where scientific or technological research, experiments, and measurement may be performed.

Paper Scheduling System

A manual system used for planning and organizing appointments, often utilized in clinics or small practitioner offices before widespread use of digital calendars.

Appointment Books

Books or digital tools used for recording dates, times, and details of meetings or appointments.

Electronic Scheduling System

A digital tool used for organizing appointments, meetings, or events, improving efficiency and accessibility over traditional paper-based systems.

Q6: Assume the partnership of Dean, Hardin, and

Q9: Lucky Co. had cash of $65,000, inventory

Q13: Westmore, Ltd. is a British subsidiary of

Q28: Virginia Corp. owned all of the voting

Q54: What is the purpose of the SEC's

Q71: Delta Corporation owns 90 percent of Sigma

Q89: Faru Co. identified five industry segments: (1)

Q92: West Corp. owned 70% of the voting

Q93: A highly inflationary economy is defined as<br>A)

Q105: Femur Co. acquired 70% of the voting