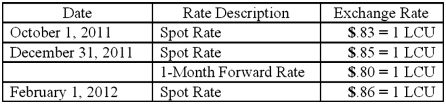

On October 1, 2011, Jarvis Co. sold inventory to a customer in a foreign country, denominated in 100,000 local currency units (LCU). Collection is expected in four months. On October 1, 2011, a forward exchange contract was acquired whereby Jarvis Co. was to pay 100,000 LCU in four months (on February 1, 2012) and receive $78,000 in U.S. dollars. The spot and forward rates for the LCU were as follows:  The company's borrowing rate is 12%. The present value factor for one month is .9901.

The company's borrowing rate is 12%. The present value factor for one month is .9901.

Any discount or premium on the contract is amortized using the straight-line method.

Assuming this is a fair value hedge; prepare journal entries for this sales transaction and forward contract.

Definitions:

Market Price

The current value at which an asset, commodity, or service can be bought or sold in a marketplace.

Price-earnings Ratio

A valuation ratio of a company's current share price compared to its per-share earnings, used to evaluate the attractiveness of a stock.

Dividend Yield

A financial ratio that indicates how much a company pays out in dividends each year relative to its share price, serving as a measure of return on investment.

Earnings Per Share

A financial ratio that calculates the portion of a company’s profit allocated to each outstanding share of common stock, serving as an indicator of a company's profitability.

Q3: Pepe, Incorporated acquired 60% of Devin Company

Q18: River Co. owned 80% of Boat Inc.

Q27: Bazley Co. had severe financial difficulties and

Q39: Dithers Inc. acquired all of the common

Q62: Which of the following statements is false

Q63: Certain balance sheet accounts of a foreign

Q67: Which one of the following forms is

Q88: These questions are based on the following

Q90: Belsen purchased inventory on December 1, 2010.

Q100: Beagle Co. owned 80% of Maroon Corp.