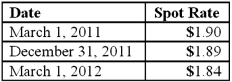

On March 1, 2011, Mattie Company received an order to sell a machine to a customer in England at a price of 200,000 British pounds. The machine was shipped and payment was received on March 1, 2012. On March 1, 2011, Mattie purchased a put option giving it the right to sell 200,000 British pounds on March 1, 2012 at a price of $380,000. Mattie properly designates the option as a fair hedge of the pound firm commitment. The option cost $2,000 and had a fair value of $2,200 on December 31, 2011. The following spot exchange rates apply:  Mattie's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803. What was the net impact on Mattie's 2012 income as a result of this fair value hedge of a firm commitment?

Mattie's incremental borrowing rate is 12 percent, and the present value factor for two months at a 12 percent annual rate is .9803. What was the net impact on Mattie's 2012 income as a result of this fair value hedge of a firm commitment?

Definitions:

Developing Countries

Nations with lower levels of industrialization, lower standards of living, and lower Human Development Index ratings compared to developed countries.

International Finance Corporation

A member of the World Bank Group, the IFC focuses on the private sector in developing countries, providing investment, advice, and asset management services to encourage economic development.

Private Enterprises

Businesses owned by individuals or groups, not by the state, operating for profit in a free market.

Q14: Darron Co. was formed on January 1,

Q23: A foreign subsidiary uses the first-in first-out

Q46: Chase Company owns 80% of Lawrence Company

Q59: On January 1, 2010, Smeder Company, an

Q65: Hardin, Sutton, and Williams have operated a

Q79: Dean Hardware, Inc. is comprised of five

Q80: What is normally required before a reorganization

Q87: Delta Corporation owns 90 percent of Sigma

Q98: Prince Corp. owned 80% of Kile Corp.'s

Q109: Wilson owned equipment with an estimated life