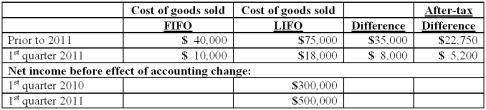

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2011. Baker has an effective income tax rate of 30 percent and 100,000 shares of common stock issued and outstanding. The following additional information is available:  Assuming Baker makes the change in the first quarter of 2011, how much is reported as net income for the first quarter of 2011?

Assuming Baker makes the change in the first quarter of 2011, how much is reported as net income for the first quarter of 2011?

Definitions:

Ukrainian Language Comprehension

The ability to understand and process the Ukrainian language, including its vocabulary, grammar, and pronunciation.

Language Lessons

Language lessons refer to structured periods of instruction designed to teach the vocabulary, grammar, pronunciation, and usage of a particular language.

Lifelong Nonspeakers

Individuals who, due to various conditions, do not develop the ability to speak throughout their lifetime.

Information-Processing Theorists

Researchers who compare human thinking to computer processing, looking at how people take in, use, and store information.

Q12: Panton, Inc. acquired 18,000 shares of Glotfelty

Q31: Which of the following statements is false

Q51: Which of the following is not a

Q51: Which one of the following forms is

Q52: The following information for Urbanski Corporation relates

Q77: Woolsey Corporation, a U.S. company, expects to

Q84: Woolsey Corporation, a U.S. company, expects to

Q95: McGuire Company acquired 90 percent of Hogan

Q111: Parsons Company acquired 90% of Roxy Company

Q123: Varton Corp. acquired all of the voting