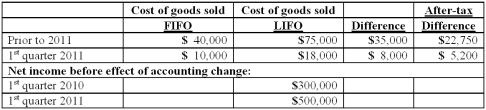

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2011. Baker has an effective income tax rate of 30 percent and 100,000 shares of common stock issued and outstanding. The following additional information is available:  Assuming Baker makes the change in the first quarter of 2011, how much is reported as net income for the first quarter of 2010?

Assuming Baker makes the change in the first quarter of 2011, how much is reported as net income for the first quarter of 2010?

Definitions:

Biomarkers

Biochemical, molecular, genetic, or structural characteristics that usually accompany a disease.

Alzheimer's Disease

A degenerative brain disorder characterized by cognitive decline and memory loss, often associated with the accumulation of amyloid plaques and tau tangles in the brain.

Longitudinal Study

A research design that involves repeated observations of the same variables (e.g., people) over a period of time, extending from months to decades.

Acetylcholine

A neurotransmitter in both the central and peripheral nervous systems that plays a crucial role in stimulating muscle contractions and involved in various brain functions.

Q4: A net liability balance sheet exposure exists

Q9: White Company owns 60% of Cody Company.

Q19: Pell Company acquires 80% of Demers Company

Q27: In translating a foreign subsidiary's financial statements,

Q36: Under the temporal method, retained earnings would

Q42: The SEC's role in the initial registration

Q44: River Co. owned 80% of Boat Inc.

Q56: What is the purpose of Chapter 7

Q78: Knight Co. owned 80% of the common

Q85: How does a foreign currency forward contract