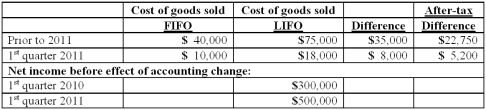

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2011. Baker has an effective income tax rate of 30 percent and 100,000 shares of common stock issued and outstanding. The following additional information is available:  Assuming Baker makes the change in the first quarter of 2011 and that $400,000 net income is earned during the second quarter, how much is reported as net income for the second quarter of 2011?

Assuming Baker makes the change in the first quarter of 2011 and that $400,000 net income is earned during the second quarter, how much is reported as net income for the second quarter of 2011?

Definitions:

National Security Adviser

A senior official in the executive government, serving as the chief in-house advisor to the President on national security issues.

Military-Industrial Complex

The relationship between a country's military and the defense industry that supplies it, seen as a vested interest which influences public policy.

High-Tech Weaponry

Advanced or sophisticated military technology and armaments, often incorporating electronic, digital, or new material innovations.

Vietnam Syndrome

A term used to describe the reluctance of the United States to engage in future military interventions abroad due to the psychological trauma of the Vietnam War.

Q1: Vapor Corporation has a fan products operating

Q4: Why do intra-entity transfers between the component

Q21: On a statement of financial affairs, a

Q26: McGuire Company acquired 90 percent of Hogan

Q38: Gamma Co. owns 80% of Delta Corp.,

Q50: The benefits of filing a consolidated tax

Q60: Virginia Corp. owned all of the voting

Q68: Jull Corp. owned 80% of Solaver Co.

Q76: A net liability balance sheet exposure exists

Q114: Tosco Co. paid $540,000 for 80% of