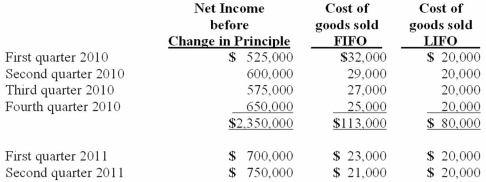

Harrison Company, Inc. began operations on January 1, 2010, and applied the LIFO method for inventory valuation. On June 10, 2011, Harrison adopted the FIFO method of accounting for inventory. Additional information is as follows:  The LIFO method was applied during the first quarter of 2011 and the FIFO method was applied during the second quarter of 2011 in computing income, above. Harrison's effective income tax rate is 40 percent. Harrison has 500,000 shares of common stock outstanding at all times.

The LIFO method was applied during the first quarter of 2011 and the FIFO method was applied during the second quarter of 2011 in computing income, above. Harrison's effective income tax rate is 40 percent. Harrison has 500,000 shares of common stock outstanding at all times.

Compute the after-tax effect of Harrison's change in inventory method.

Definitions:

Fluid and Electrolyte Imbalance

A condition where the body's water content and the levels of ions are either too high or too low.

Level of Consciousness

The degree of alertness or responsiveness of a person; a measure of a person's wakefulness and ability to respond to stimuli.

Cognitive Impairment

A condition where an individual has trouble remembering, learning new things, concentrating, or making decisions that affect their everyday life.

Mini-Cog Test

A brief screening tool used to evaluate cognitive function, particularly to screen for signs of dementia or Alzheimer's disease; it involves memory and clock drawing tests.

Q29: Dean Hardware, Inc. is comprised of five

Q36: Which of the following are issued by

Q37: What happens when a U.S. company purchases

Q51: A parent company owns a 70 percent

Q52: What are the four different ways IFRS

Q55: A company sells a building to a

Q80: Pigskin Co., a U.S. corporation, sold inventory

Q80: Gargiulo Company, a 90% owned subsidiary of

Q85: How does the partial equity method differ

Q91: A subsidiary issues new shares of common