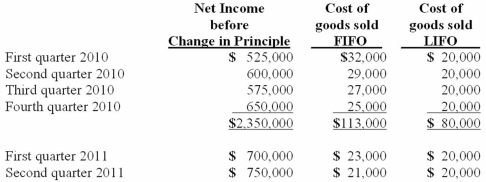

Harrison Company, Inc. began operations on January 1, 2010, and applied the LIFO method for inventory valuation. On June 10, 2011, Harrison adopted the FIFO method of accounting for inventory. Additional information is as follows:  The LIFO method was applied during the first quarter of 2011 and the FIFO method was applied during the second quarter of 2011 in computing income, above. Harrison's effective income tax rate is 40 percent. Harrison has 500,000 shares of common stock outstanding at all times.

The LIFO method was applied during the first quarter of 2011 and the FIFO method was applied during the second quarter of 2011 in computing income, above. Harrison's effective income tax rate is 40 percent. Harrison has 500,000 shares of common stock outstanding at all times.

Prepare a schedule showing the calculation of net income and earnings per share to be reported by Harrison for the three-month period and the six-month period ended June 30, 2010 and 2011.

Definitions:

Fractures

Breaks in rock or mineral without the movement parallel to the surface of the break, often a result of stress exceeding the strength of the material.

Underground Lakes

Bodies of water that exist beneath the Earth's surface, often found in caves or formed by natural aquifers.

Porosity

A measure of how much of a rock is open space, which can hold water, oil, or gas.

Dry

indicates a lack of moisture or water content.

Q7: Under the temporal method, inventory at market

Q17: Car Corp. (a U.S.-based company) sold parts

Q21: Which of the following is not a

Q34: T Corp. owns several subsidiaries that are

Q50: Yoderly Co., a wholly owned subsidiary of

Q60: Which one of the following requires the

Q66: Regulation S-K:<br>A) controls the listing of securities

Q99: Dean Hardware, Inc. is comprised of five

Q109: How should revenues be recognized in interim

Q113: McGuire Company acquired 90 percent of Hogan