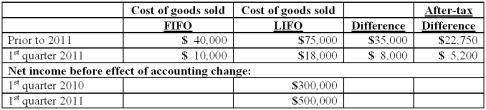

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2011. Baker has an effective income tax rate of 30 percent and 100,000 shares of common stock issued and outstanding. The following additional information is available:  Assuming Baker makes the change in the first quarter of 2011, how much is reported as net income for the first quarter of 2011?

Assuming Baker makes the change in the first quarter of 2011, how much is reported as net income for the first quarter of 2011?

Definitions:

Level Of Activity

A measure of the volume of production or operations within a business, used to allocate costs or plan for capacities.

Direct Labor Cost

The total expense incurred by a company for the wages of individuals directly involved in the production of goods or services.

Activity Level

A measure of the volume or quantity of production or operations within a specific period.

Direct Proportion

A relationship between two quantities where they increase or decrease at the same rate.

Q1: Brisco Bricks purchases raw material from its

Q9: What is the major assumption underlying the

Q17: Which of the following is not an

Q19: A company incurs research and development costs

Q22: McGraw Corp. owned all of the voting

Q37: Pell Company acquires 80% of Demers Company

Q54: Ryan Company owns 80% of Chase Company.

Q80: Under the current rate method, how would

Q90: Pell Company acquires 80% of Demers Company

Q113: How is the gain on an intra-entity