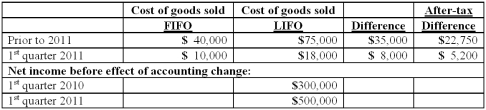

Baker Corporation changed from the LIFO method to the FIFO method for inventory valuation during 2011. Baker has an effective income tax rate of 30 percent and 100,000 shares of common stock issued and outstanding. The following additional information is available:  Assuming Baker makes the change in the first quarter of 2011, compute net income per common share.

Assuming Baker makes the change in the first quarter of 2011, compute net income per common share.

Definitions:

Q1: McGuire Company acquired 90 percent of Hogan

Q3: Which one of the following is a

Q4: Schilling, Inc. has three operating segments with

Q6: Wolff Corporation owns 70 percent of the

Q14: The IASB and FASB are working on

Q27: Betsy Kirkland, Inc. incurred a flood loss

Q42: Sinkal Co. was formed on January 1,

Q86: Which of the following operating segment disclosures

Q100: What is the purpose of the adjustments

Q109: Anderson, Inc. has owned 70% of its