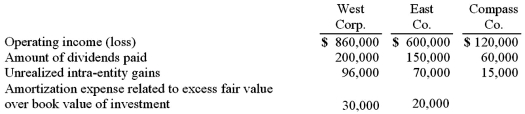

West Corp. owned 70% of the voting common stock of East Co. East owned 60% of Compass Co. West and East both used the initial value method to account for their investments. The following information was available from the financial statements and records of the three companies:  Operating income included unrealized intra-entity gains (which are related to inventory transfers) but did not include dividend income from investment in subsidiary. The accrual-based income of West Corp. is calculated to be

Operating income included unrealized intra-entity gains (which are related to inventory transfers) but did not include dividend income from investment in subsidiary. The accrual-based income of West Corp. is calculated to be

Definitions:

Q6: Blanton Corporation is comprised of five operating

Q16: McGuire Company acquired 90 percent of Hogan

Q20: Delta Corporation owns 90 percent of Sigma

Q23: Which items of information are required to

Q25: Pennant Corp. owns 70% of the common

Q77: Prescott Corp. owned 90% of Bell Inc.,

Q86: Which of the following operating segment disclosures

Q87: Coyote Corp. (a U.S. company in Texas)

Q94: Quadros Inc., a Portuguese firm was acquired

Q114: Where do intra-entity sales of inventory appear