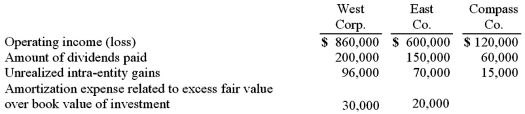

West Corp. owned 70% of the voting common stock of East Co. East owned 60% of Compass Co. West and East both used the initial value method to account for their investments. The following information was available from the financial statements and records of the three companies:  Operating income included unrealized intra-entity gains (which are related to inventory transfers) but did not include dividend income from investment in subsidiary. What amount of dividends did West Corp. receive from Compass Co.?

Operating income included unrealized intra-entity gains (which are related to inventory transfers) but did not include dividend income from investment in subsidiary. What amount of dividends did West Corp. receive from Compass Co.?

Definitions:

Customers

Individuals or businesses that purchase goods or services produced by a company.

Commissioned Sales Rep

A salesperson who earns income based on the amount of sales they generate, receiving a percentage of the sales as their commission.

High-end Retail

Retailers that specialize in selling luxury or premium products and services, often characterized by quality, exclusivity, and high price points.

Purchases

Transactions in which goods or services are acquired in exchange for money or other forms of compensation.

Q19: Pell Company acquires 80% of Demers Company

Q21: Jet Corp. acquired all of the outstanding

Q30: On November 10, 2011, King Co. sold

Q47: Chase Company owns 80% of Lawrence Company

Q49: What approach is used, according to U.S.

Q76: When a subsidiary is acquired sometime after

Q78: Elektronix, Inc. has three operating segments with

Q87: In translating a foreign subsidiary's financial statements,

Q95: An intra-entity sale took place whereby the

Q95: A U.S. company's foreign subsidiary had the