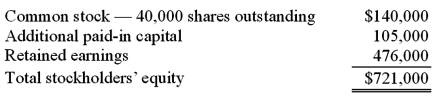

These questions are based on the following information and should be viewed as independent situations. Popper Co. acquired 80% of the common stock of Cocker Co. on January 1, 2009, when Cocker had the following stockholders' equity accounts.  To acquire this interest in Cocker, Popper paid a total of $682,000 with any excess acquisition date fair value over book value being allocated to goodwill, which has been measured for impairment annually and has not been determined to be impaired as of January 1, 2012.

To acquire this interest in Cocker, Popper paid a total of $682,000 with any excess acquisition date fair value over book value being allocated to goodwill, which has been measured for impairment annually and has not been determined to be impaired as of January 1, 2012.

On January 1, 2012, Cocker reported a net book value of $1,113,000 before the following transactions were conducted. Popper uses the equity method to account for its investment in Cocker, thereby reflecting the change in book value of Cocker.

On January 1, 2012, Cocker issued 10,000 additional shares of common stock for $21 per share. Popper did not acquire any of this newly issued stock. How would this transaction affect the additional paid-in capital of the parent company?

Definitions:

Full-fare Air Ticket

A Full-fare Air Ticket is the purchase price for an airline seat without any discounts or promotions, usually offering maximum flexibility in terms of changes and cancellations.

Decision Tree

A graphical representation of possible solutions to a decision based on certain conditions or probabilities.

Probability

The measure of the likelihood that an event will occur, expressed as a number between 0 and 1.

Coefficient of Variation

A measure of relative variability calculated as the standard deviation divided by the mean, often expressed as a percentage.

Q3: Following are selected accounts for Green Corporation

Q17: Which one of the following accounts would

Q33: Dilty Corp. owned a subsidiary in France.

Q47: Chase Company owns 80% of Lawrence Company

Q51: Which of the following is not a

Q75: Tower Company owns 85% of Hill Company.

Q84: On January 1, 2010, Cale Corp. paid

Q96: Generally accepted accounting principles require a U.S.

Q99: Gentry Inc. acquired 100% of Gaspard Farms

Q112: Gargiulo Company, a 90% owned subsidiary of