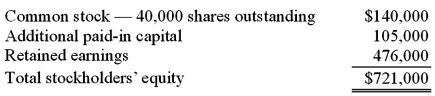

These questions are based on the following information and should be viewed as independent situations. Popper Co. acquired 80% of the common stock of Cocker Co. on January 1, 2009, when Cocker had the following stockholders' equity accounts.  To acquire this interest in Cocker, Popper paid a total of $682,000 with any excess acquisition date fair value over book value being allocated to goodwill, which has been measured for impairment annually and has not been determined to be impaired as of January 1, 2012.

To acquire this interest in Cocker, Popper paid a total of $682,000 with any excess acquisition date fair value over book value being allocated to goodwill, which has been measured for impairment annually and has not been determined to be impaired as of January 1, 2012.

On January 1, 2012, Cocker reported a net book value of $1,113,000 before the following transactions were conducted. Popper uses the equity method to account for its investment in Cocker, thereby reflecting the change in book value of Cocker.

On January 1, 2012, Cocker issued 10,000 additional shares of common stock for $35 per share. Popper acquired 8,000 of these shares. How would this transaction affect the additional paid-in capital of the parent company?

Definitions:

Commercial Standards

Commercial Standards are established norms or criteria within a business sector that guide the quality, performance, and conduct of activities in that field.

Treated

Subjected to a specific process or course of action, typically to achieve a certain effect or outcome.

Owns

To own means to have legal right or title to an object, property, or asset, granting the holder exclusive rights to the use, enjoyment, and disposition of that asset.

Accepted

Acknowledged or agreed upon; an offer or proposal that has been received and approved.

Q2: An acquisition transaction results in $90,000 of

Q20: According to the FASB ASC regarding the

Q21: Elektronix, Inc. has three operating segments with

Q27: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4176/.jpg" alt=" Patton's operating income

Q45: Describe the test to determine whether a

Q46: Regency Corp. recently acquired $500,000 of the

Q52: What method is used in consolidation to

Q78: What is the purpose of a hedge

Q82: Strickland Company sells inventory to its parent,

Q112: Faru Co. identified five industry segments: (1)