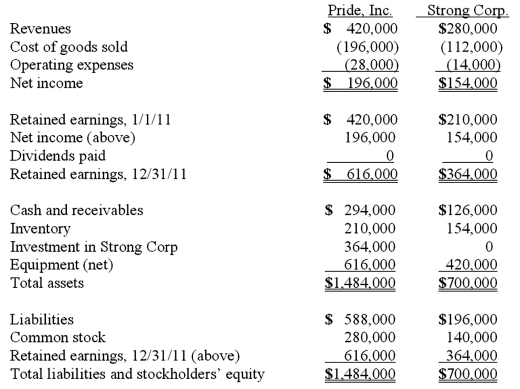

On January 1, 2011, Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. There is no active market for Strong's stock. Of this payment, $28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000. Any remaining excess was attributable to goodwill which has not been impaired. As of December 31, 2011, before preparing the consolidated worksheet, the financial statements appeared as follows:  During 2011, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of this purchase had been paid for by Strong by the end of the year. 60% of these goods were still in the company's possession on December 31.

During 2011, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of this purchase had been paid for by Strong by the end of the year. 60% of these goods were still in the company's possession on December 31.

What is the total of consolidated revenues?

Definitions:

Avoidable Cost

Expenses that can be eliminated if a particular decision or action is avoided.

Financially Better

A general term that implies an improvement in financial condition or performance compared to a previous period.

Variable Expenses

Costs that fluctuate in direct proportion to changes in the level of activity or business operations, such as materials and labor.

Fixed Expenses

Costs that do not change with the level of production or sales activity, such as rent, salaries, and insurance.

Q28: Farley Brothers, a U.S. company, had a

Q48: On January 1, 2010, Jumper Co. acquired

Q48: Which one of the following items is

Q57: Dean, Inc. owns 90 percent of Ralph,

Q78: All of the following would require use

Q78: Matthews Co. acquired all of the common

Q89: What exchange rate should be used to

Q100: What is the purpose of the adjustments

Q107: Elektronix, Inc. has three operating segments with

Q111: On January 1, 2011, Bangle Company purchased