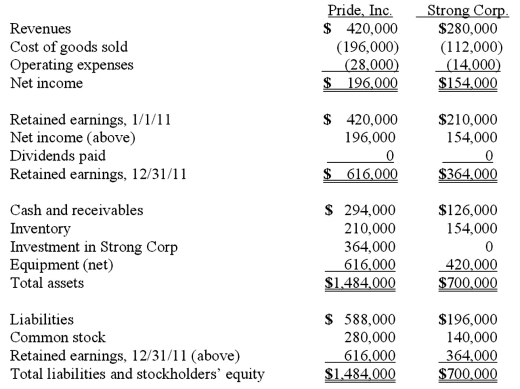

On January 1, 2011, Pride, Inc. acquired 80% of the outstanding voting common stock of Strong Corp. for $364,000. There is no active market for Strong's stock. Of this payment, $28,000 was allocated to equipment (with a five-year life) that had been undervalued on Strong's books by $35,000. Any remaining excess was attributable to goodwill which has not been impaired. As of December 31, 2011, before preparing the consolidated worksheet, the financial statements appeared as follows:  During 2011, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of this purchase had been paid for by Strong by the end of the year. 60% of these goods were still in the company's possession on December 31.

During 2011, Pride bought inventory for $112,000 and sold it to Strong for $140,000. Only half of this purchase had been paid for by Strong by the end of the year. 60% of these goods were still in the company's possession on December 31.

What is the consolidated total for inventory at December 31, 2011?

Definitions:

Millicurie

A unit of radioactivity equal to one-thousandth of a curie, measuring the amount of radioactivity.

Computerized Axial Tomography

An advanced imaging procedure that uses X-rays and computer processing to create cross-sectional images of the body, also known as a CT scan.

Magnetic Resonance Imaging

An imaging test that uses a magnetic field and radio waves to create detailed images of the organs and tissues within the body.

Radiation Absorbed Dose

A unit of measurement for the amount of radiation energy absorbed by a mass of material, typically tissue.

Q3: The following information for Urbanski Corporation relates

Q5: Boerkian Co. started 2011 with two assets:

Q7: Several years ago Polar Inc. acquired an

Q26: Which of the following is not a

Q44: All of the following are acceptable methods

Q50: The benefits of filing a consolidated tax

Q56: Which of the following internal record-keeping methods

Q58: Acquired in-process research and development is considered

Q69: Walsh Company sells inventory to its subsidiary,

Q88: What happens when a U.S. company sells