Several years ago Polar Inc. acquired an 80% interest in Icecap Co. The book values of Icecap's asset and liability accounts at that time were considered to be equal to their fair values. Polar's acquisition value corresponded to the underlying book value of Icecap so that no allocations or goodwill resulted from the transaction.

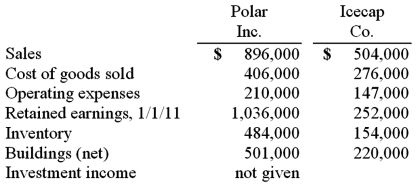

The following selected account balances were from the individual financial records of these two companies as of December 31, 2011:  Assume that Polar sold inventory to Icecap at a markup equal to 25% of cost. Intra-entity transfers were $130,000 in 2010 and $165,000 in 2011. Of this inventory, $39,000 of the 2010 transfers were retained and then sold by Icecap in 2011, while $55,000 of the 2011 transfers were held until 2012.

Assume that Polar sold inventory to Icecap at a markup equal to 25% of cost. Intra-entity transfers were $130,000 in 2010 and $165,000 in 2011. Of this inventory, $39,000 of the 2010 transfers were retained and then sold by Icecap in 2011, while $55,000 of the 2011 transfers were held until 2012.

Required:

For the consolidated financial statements for 2011, determine the balances that would appear for the following accounts: (1) Cost of Goods Sold, (2) Inventory, and (3) Non-controlling Interest in Subsidiary's Net Income.

Definitions:

Formal Planning Model

A systematic, organized approach to planning based on theories and models to achieve desired outcomes.

Fast Food Restaurants

These are eateries that specialize in serving food quickly to customers, often featuring limited service and specializing in a few menu items.

Manufacturing

The process of converting raw materials, components, or parts into finished goods that meet a consumer's expectations or specifications.

Hi-Fi Stereo System

A high-fidelity sound system designed to reproduce audio with minimal distortion and a high degree of accuracy.

Q15: Gargiulo Company, a 90% owned subsidiary of

Q17: On January 1, 2009, Nichols Company acquired

Q19: Pell Company acquires 80% of Demers Company

Q32: When a parent uses the equity method

Q61: Wilson owned equipment with an estimated life

Q70: Tinker Co. owns 25% of the common

Q78: Matthews Co. acquired all of the common

Q93: Perch Co. acquired 80% of the common

Q112: Hardford Corp. held 80% of Inglestone Inc.

Q114: Where do intra-entity sales of inventory appear