Several years ago Polar Inc. acquired an 80% interest in Icecap Co. The book values of Icecap's asset and liability accounts at that time were considered to be equal to their fair values. Polar's acquisition value corresponded to the underlying book value of Icecap so that no allocations or goodwill resulted from the transaction.

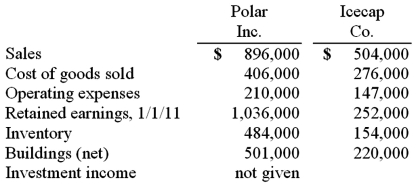

The following selected account balances were from the individual financial records of these two companies as of December 31, 2011:  Assume that Icecap sold inventory to Polar at a markup equal to 25% of cost. Intra-entity transfers were $70,000 in 2010 and $112,000 in 2011. Of this inventory, $29,000 of the 2010 transfers were retained and then sold by Polar in 2011, whereas $49,000 of the 2011 transfers were held until 2012.

Assume that Icecap sold inventory to Polar at a markup equal to 25% of cost. Intra-entity transfers were $70,000 in 2010 and $112,000 in 2011. Of this inventory, $29,000 of the 2010 transfers were retained and then sold by Polar in 2011, whereas $49,000 of the 2011 transfers were held until 2012.

Required:

For the consolidated financial statements for 2011, determine the balances that would appear for the following accounts: (1) Cost of Goods Sold, (2) Inventory, and (3) Non-controlling Interest in Subsidiary's Net Income.

Definitions:

Consumer Utility

The satisfaction or benefit a consumer receives from consuming a good or service.

Combination

The selection of items or data points from a larger set without regard to the order in which they are selected.

Utility

Refers to the total satisfaction received from consuming a good or service.

Characteristics

Distinctive features or qualities that identify and distinguish something or someone.

Q18: River Co. owned 80% of Boat Inc.

Q23: The financial statements for Jode Inc. and

Q37: Presented below are the financial balances for

Q42: Femur Co. acquired 70% of the voting

Q49: How does a parent company account for

Q64: Pursley, Inc. owns 70 percent of Harry,

Q82: Perry Company acquires 100% of the stock

Q85: Idler Co. has an investment in Cowl

Q104: Retro Corp. was engaged solely in manufacturing

Q116: When a company applies the partial equity