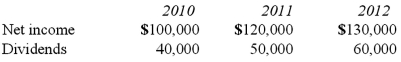

Pell Company acquires 80% of Demers Company for $500,000 on January 1, 2010. Demers reported common stock of $300,000 and retained earnings of $210,000 on that date. Equipment was undervalued by $30,000 and buildings were undervalued by $40,000, each having a 10-year remaining life. Any excess consideration transferred over fair value was attributed to goodwill with an indefinite life. Based on an annual review, goodwill has not been impaired. Demers earns income and pays dividends as follows:  Assume the equity method is applied.

Assume the equity method is applied.

Compute the non-controlling interest in the net income of Demers at December 31, 2012.

Definitions:

Restaurant

A business establishment that prepares and serves meals, snacks, and beverages to customers.

Departmental Gross Profit

The difference between sales and the cost of goods sold for a specific department, highlighting its profitability.

Revenue

An amount earned by performing services for customers or selling goods to customers; it can be in the form of cash or accounts receivable. A subdivision of owner’s equity: As revenue increases, owner’s equity increases.

Breakfast Department

A specific business unit within a hospitality organization that is responsible for managing and operating the breakfast service.

Q5: The phoneme /f/ is a linguadental speech

Q5: Alpha Corporation owns 100 percent of Beta

Q16: Avery Company acquires Billings Company in a

Q66: During 2010, Von Co. sold inventory to

Q69: Walsh Company sells inventory to its subsidiary,

Q76: What documents or other sources of information

Q84: On January 3, 2011, Roberts Company purchased

Q84: On January 1, 2011, Race Corp. acquired

Q93: Perry Company acquires 100% of the stock

Q115: Renfroe, Inc. acquires 10% of Stanley Corporation