On January 1, 2009, Vacker Co. acquired 70% of Carper Inc. by paying $650,000. This included a $20,000 control premium. Carper reported common stock on that date of $420,000 with retained earnings of $252,000. A building was undervalued in the company's financial records by $28,000. This building had a ten-year remaining life. Copyrights of $80,000 were to be recognized and amortized over 20 years.

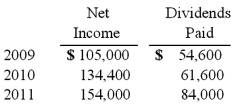

Carper earned income and paid cash dividends as follows:  On December 31, 2011, Vacker owed $30,800 to Carper. There have been no changes in Carper's common stock account since the acquisition.

On December 31, 2011, Vacker owed $30,800 to Carper. There have been no changes in Carper's common stock account since the acquisition.

Required:

If the equity method had been applied by Vacker for this acquisition, what were the consolidation entries needed as of December 31, 2011?

Definitions:

Monosomy

Chromosome condition in which a diploid cell has one less chromosome than normal; designated as 2n − 1.

Complete Chromosome

A fully intact and functional chromosome that contains all its genetic information and structures needed for normal cellular activities and division.

Loss

The act or an instance of losing, referring to the fact or process of losing something or someone, typically in a financial, emotional, or physical context.

Locus

Physical location of a trait (or gene) on a chromosome.

Q10: On November 8, 2011, Power Corp. sold

Q34: Where may a non-controlling interest be presented

Q34: What would differ between a statement of

Q40: Kordel Inc. acquired 75% of the outstanding

Q55: What term is used to refer to

Q58: Faru Co. identified five industry segments: (1)

Q64: On January 1, 2010, Mehan, Incorporated purchased

Q71: Stiller Company, an 80% owned subsidiary of

Q84: Flynn acquires 100 percent of the outstanding

Q123: Varton Corp. acquired all of the voting